For a better healthy life

Let me guide you in the complex world of health care. These are the services that I can provide to you:

Employer Group Benefits

Traditionally, people obtain their coverage through their employer, hence the term “Group Benefits”. The main advantage is employees pay lower premiums and, in some cases, receive better coverage than if they purchase insurance on their own. In return, employers can use their benefits package to attract and retain quality employees

Even with the evolution of the market thanks to health care reforms, where people are now being enabled to get their benefit coverages from different places and even at group rates, most people will still obtain their coverage from their employer. This will remain vital in the employees/employer market.

Individual Health Plans

Getting an individual health plan will be an advantage. You can choose the insurance company, the plan, and the options that meet your needs. You can renew or change health insurance plans, options, and health insurance companies during the annual Open Enrollment period and even the possibility to get group rates. Be in control of your needs.

Guarantees for the “if” in life

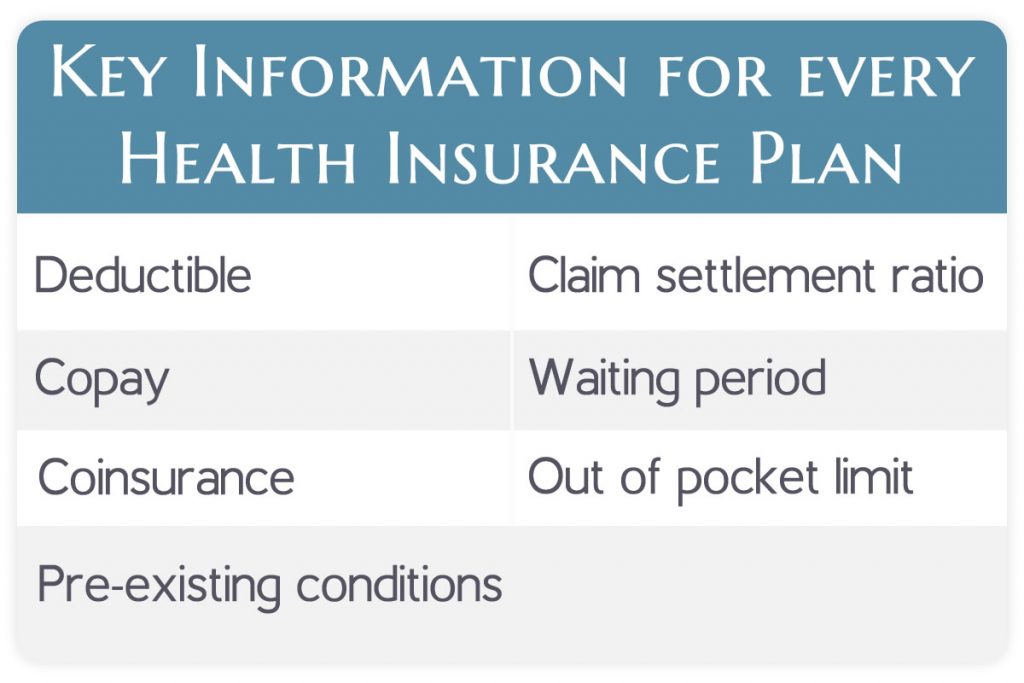

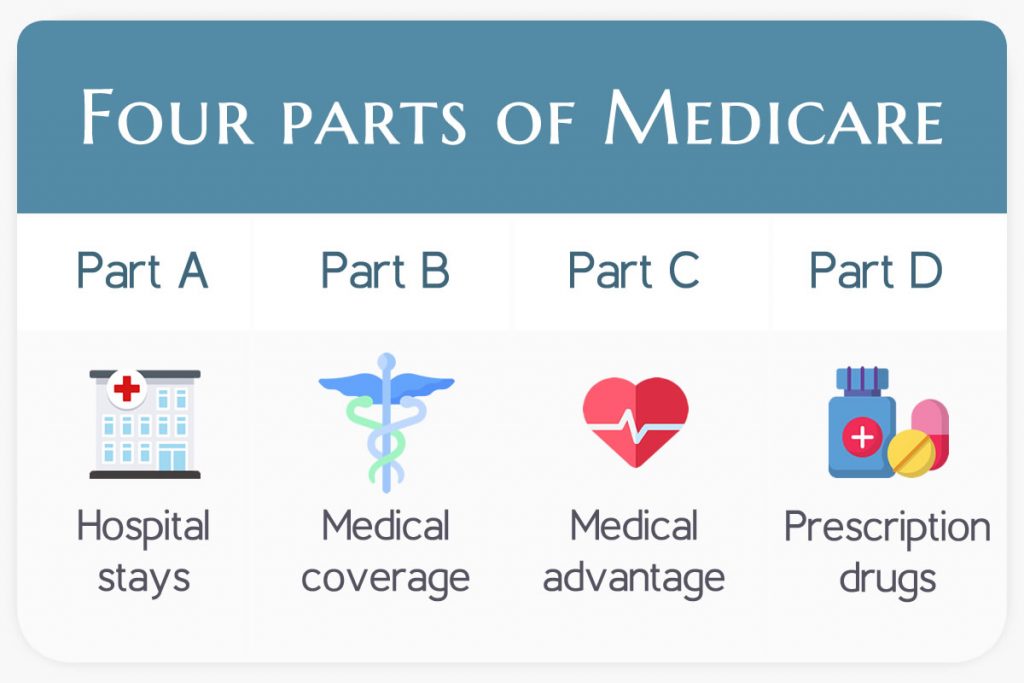

Medicare Health Plans

Disability

As its name suggests, disability insurance is a type of insurance product that provides an income if a policyholder is prevented from working and earning an income due to a disability. Individuals can obtain disability insurance from the government through the Social Security System or purchase from private insurers.

Source: Disability statistics, Council for Disability Awareness

Accident

Accident Insurance can help you until you’re back on your feet. Major medical insurance sometimes doesn’t cover everything (copays, deductibles, transportations, lost wages, and more) and approximately 77% of all accidents in the U.S. happen outside the workplace- and aren’t covered by worker’s compensation.

For those reasons, getting extra coverage with Accident Insurance may be the right thing.

Benefits

- Benefits are paid directly to you, regardless of any other insurance you may have.

- Benefits have no lifetime maximums.

- Rates won’t increase just because you use your policy benefits

Source: National Safety Council, “Injury Facts,” 2017 Edition

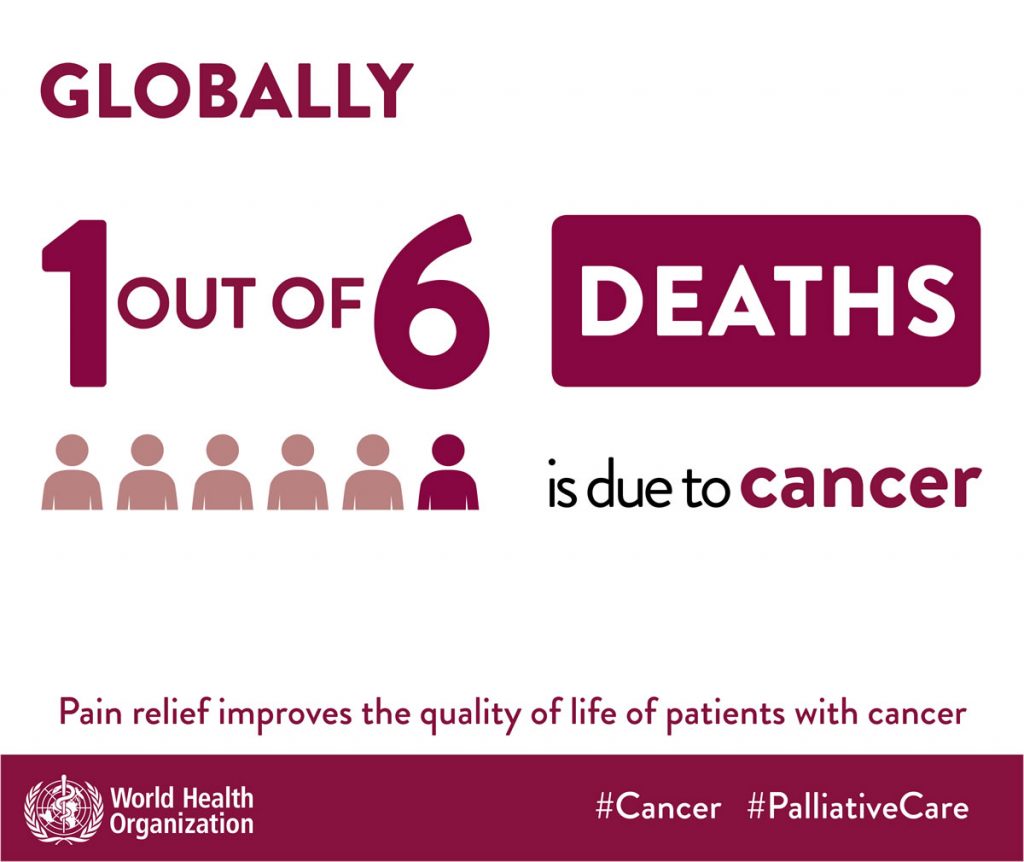

Cancer

This word is quite scary not only for the disease per se, but the possibility of not being covered by your regular insurance health plan.

Cancer insurance can help pay for both medical and nonmedical costs like co-pays, deductibles, lengthy hospital stays, diagnostics tests, treatments and procedures, child care, travel, and lodging expenses, lost income, and more.

Reference: World Health Organization

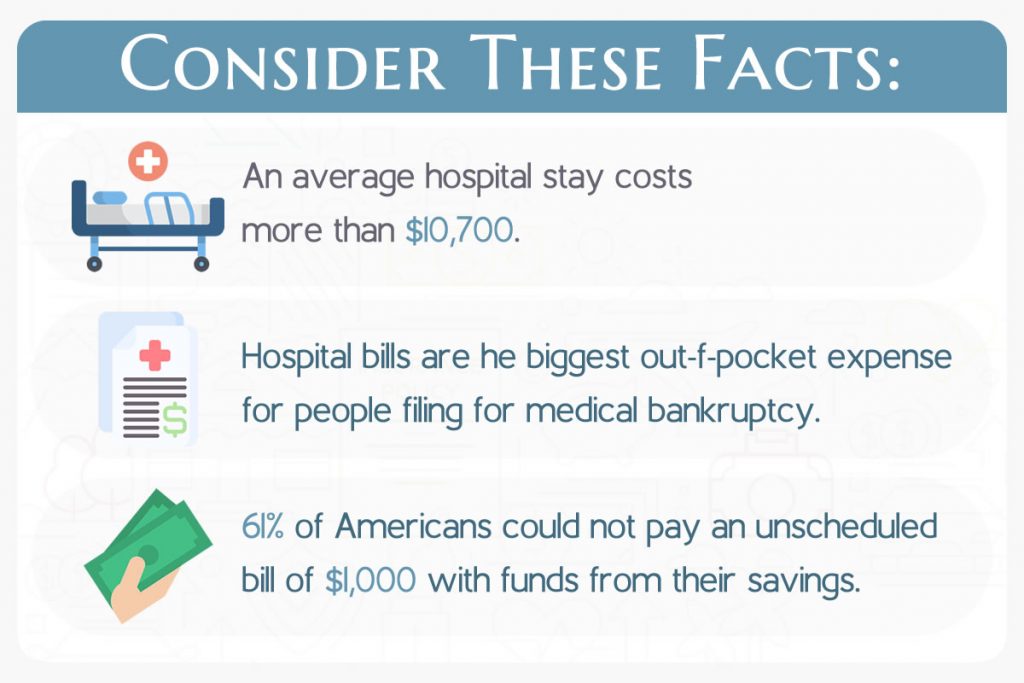

Hospital Indemnity

Hospital indemnity insurance is a supplemental insurance plan designed to pay for the costs of hospital admission that may not be covered by other insurance. The benefits are paid directly to you and can be used to cover copays, deductibles, transportation, lost wages, and more.

- Business Insider, The 35 most expensive reasons you might have to visit a hospital in the US—and how much it costs if you do, March 1, 2018.

- Healthline, How Much Does It Cost to Stay in the Hospital, July 17, 2017.

- Bankrate, Most Americans don’t have enough savings to cover a $1k emergency.